- #Does costco carry quickbooks pro with payroll 2019 how to#

- #Does costco carry quickbooks pro with payroll 2019 install#

- #Does costco carry quickbooks pro with payroll 2019 download#

#Does costco carry quickbooks pro with payroll 2019 download#

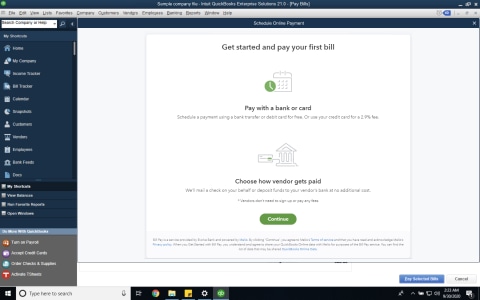

Connect bank and credit card accounts: Connect all business bank and credit cards to QBO so transactions automatically download into the software.

Track income and expenses: Keep track of all sales to customers and expenses paid to vendors.Maximum number of users (includes two accountant users)Īs you can see from the preceding table, all four editions of QBO include the following features: We will discuss each of these in detail next. The desktop version, QuickBooks Desktop ( QBD), also comes in four editions: QuickBooks Mac, Pro, Premier, and Enterprise. The cloud-based version, QuickBooks Online ( QBO), is available in four editions: Simple Start, Essentials, Plus, and Advanced.

#Does costco carry quickbooks pro with payroll 2019 install#

QuickBooks comes in two formats: a software that you can install or download on a desktop computer, and a cloud-based program that you can access from any mobile device or desktop computer with an internet connection. QuickBooks has been around for almost three decades, and it is the accounting software used by millions of small businesses around the globe. Having access to these reports makes filing your taxes a breeze. One of the benefits of using QuickBooks is having access to key financial reports (such as profit and loss) so that you can see the overall health of your business at any time. QuickBooks is an accounting software program that allows you to track your business' income and expenses. Once you've got these key concepts under your belt, you will be ready to dive into setting up your business in QBO.

#Does costco carry quickbooks pro with payroll 2019 how to#

Using a fictitious company, the book demonstrates how to create a QuickBooks Online account customize key settings for a business manage customers, vendors, and products and services generate reports and close the books at the end of the period. This book is a handy guide to using QuickBooks Online to manage accounting tasks and drawing business insights by generating reports easily. Its complete range of accounting capabilities, such as tracking income and expenses, managing payroll, simplifying taxes, and accepting online payments, makes QuickBooks software a must-have for business owners and aspiring bookkeepers. Intuit QuickBooks is an accounting software package that helps small business owners to manage all their bookkeeping tasks.

0 kommentar(er)

0 kommentar(er)